On January 23, 2023, the Federal Trade Commission (the “FTC”) announced that it will (i) increase the dollar-based thresholds that determine whether parties are required to notify federal antitrust authorities about a transaction under the Hart-Scott-Rodino Antitrust Improvements Act (“HSR”) and (ii) revise the HSR filing fee schedule. The FTC is required to revise various HSR thresholds annually based on the change in gross national product. The new thresholds will go into effect on February 27, 2023. The following are some of the more important changes:

- The threshold for the “size of transaction” test will be increased from $101 million to $111.4 million. A transaction may be reportable if the value of the voting securities, non-corporate interests and/or assets held as a result of the transaction is above this threshold and it meets the “size of person” test.

- The “size of person” test will generally be met if either the acquiring or acquired party has annual net sales or total assets of at least $222.7 million and the other party has annual net sales or total assets of at least $22.3 million, with one exception – an acquired party not engaged in manufacturing must satisfy this test on the basis of the value of its assets alone if its annual net sales are less than $222.7 million. These thresholds were previously $202 million and $20.2 million, respectively.

- Satisfaction of the “size of person” test will not be required, however, if the transaction is valued at more than $445.5 million (previously $403.9 million). Such transactions are reportable unless an exemption applies.

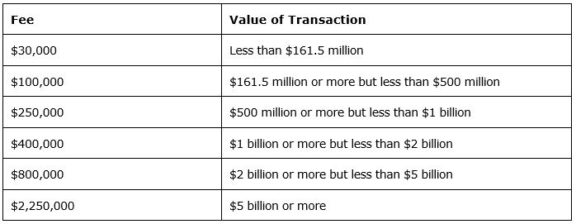

- The HSR filing fee structure has also been revised. There will now be a six-tier fee structure, with the filing fee decreasing for certain transactions and the maximum fee increasing dramatically for transactions valued at or above $5 billion. The new fee schedule is as follows:

The new HSR threshold modifications also apply to certain other thresholds and exemptions. Click here to read a full copy of the FTC’s announcement, including all of the revised thresholds.

Parties contemplating a transaction are strongly encouraged to seek legal advice to determine if the transaction triggers an HSR filing obligation pursuant to the revised thresholds. The failure to file when required to do so can subject parties to significant penalties.

If you have any questions concerning the foregoing, HSR generally or any exemptions therefrom, please contact your Seward & Kissel relationship attorney.