One word that best describes the 2024 New York City office leasing market: resilient. Due in part to the financial services sector ramping up its “return to office” policies and a dwindling supply of Trophy and Class A office space, rents are increasing and tenant inducements are decreasing.

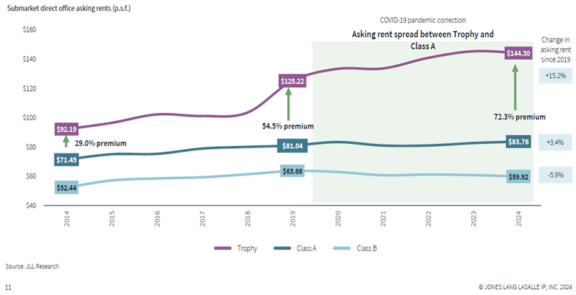

According to JLL’s latest Q3 market report, supply scarcity in the Trophy/Class A sector is impacting rental rates. Direct asking rents for Class A office space continues to increase, averaging $83.76 p.s.f. during Q3, and direct asking rents for the Trophy segment have climbed to a staggering $144.30 p.s.f.1

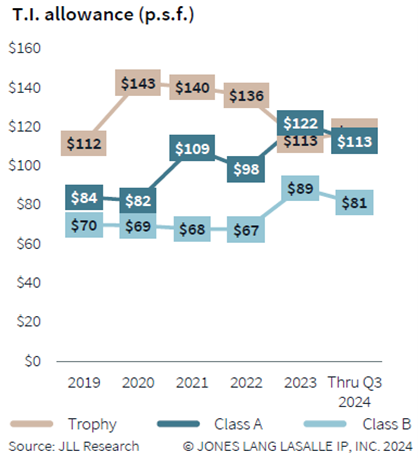

And with increasing demand, we are also seeing a decrease in average tenant inducements (typically, free rent and improvement allowance money).2

Despite these trends, we are still in the midst of a very strong “tenant market”, with landlords putting together very aggressive packages to keep their current tenants and to attract new ones.

Navigating this tight leasing market is difficult. The best advice from brokers and lawyers alike is to start the process early. The less time a tenant has before lease expiration, the more leverage the landlord has in negotiating a new lease or a renewal. Financial service providers, investment managers, family offices and all other participants in the Trophy/Class A leasing market need to plan accordingly. Determine your unique leasing needs early, and pay attention to lease expiration and option trigger dates. We are here to assist if you have any questions regarding your lease or the current leasing environment.

If you have any questions, please contact Rhona Kisch (212-574-1510) or Ian Silver (212-574-1209) of the Real Estate Practice Group or your primary Seward & Kissel attorney.