ISDA on October 23, 2020 published its long-awaited ISDA 2020 IBOR Fallbacks Protocol (the “Protocol”) and ISDA IBOR Fallbacks Supplement (the “Supplement”). The Protocol and Supplement will be effective on January 25, 2021, and the Protocol is now open for adherence. The Protocol and Supplement will provide financial market participants a means to replace the rate benchmark fallbacks currently incorporated in swap transactions, as well as those used in certain widely-used non-ISDA agreements.

LIBOR, the leading global benchmark interest rate, together with other major interest rate benchmarks (each referred to as an “IBOR” for purposes of this note), will be phased out by the end of 2021. The fallbacks that are currently incorporated in the 2006 ISDA Definitions were not drafted in contemplation of a permanent cessation of the IBORs used to determine the floating amounts for swap transactions. In addition, the market-standard master agreements for repurchase and securities lending transactions, while not incorporating the ISDA Definitions, also reference IBORs and have fallback provisions that will be inadequate to the task of addressing a cessation of the IBORs.

What do the Protocol and Supplement do?

The Protocol and Supplement are designed to address the temporary unavailability or cessation of an IBOR by updating the fallback provisions in new swap transactions, existing transactions, and a specified set of additional non-ISDA master agreements.

- The Supplement will automatically apply to uncleared derivatives contracts entered into on or after January 25, 2021 and that incorporate the 2006 ISDA Definitions. The Supplement will amend the 2006 ISDA Definitions, effective as of that date, by introducing new fallbacks that will apply for each of the following IBORs:

- U.S. Dollar London Interbank Offered Rate (USD-LIBOR)

- Sterling London Interbank Offered Rate (GBP-LIBOR)

- Euro London Interbank Offered Rate (EUR-LIBOR)

- Euro Interbank Offered Rate (EUR-IBOR)

- Swiss Franc London Interbank Offered Rate (CHF-LIBOR)

- Japanese Yen London Interbank Offered Rate (JPY-LIBOR)

- Japanese Yen Tokyo Interbank Offered Rate (TIBOR)

- Euroyen Tokyo Interbank Offered Rate (Euroyen TIBOR)

- Bank Bill Swap Rate (BBSW)

- Canadian Dollar Offered Rate (CDOR)

- Hong Kong Interbank Offered Rate (HIBOR)

- Singapore Dollar Swap Offer Rate (SOR)

- Thai Bhat Interest Rate Fixing (THBFIX)

- London Interbank Offered Rate (no specified currency)

- The Protocol amends existing OTC derivatives transactions, master agreements, credit support documents and confirmations that incorporate the 2006 ISDA Definitions, as well as certain prior iterations of the ISDA Definitions that are still in use: the 1991 ISDA Definitions (as amended by the 1998 Supplement), the 1998 ISDA Euro Definitions, and the 2000 ISDA Definitions. The Protocol will apply to any such agreement that:

- was entered into prior to January 25, 2021;

- incorporates any of these ISDA Definitions; and either

- references any rate “as defined in” these ISDA Definitions; or

- otherwise references any of the above-listed IBORs.

- The Protocol will also apply to 74 specified non-ISDA master agreements (each an “Additional Master Agreement”) and 7 additional credit support documents (each an “Additional Credit Support Document”) that reference IBORs but do not incorporate the ISDA Definitions. Among the agreements included are the following widely used repurchase and securities lending master agreements:

- 1996 TBMA Master Repurchase Agreement (MRA)

- 2000 TBMA/ISMA Global Master Repurchase Agreement (GMRA)

- 2011 SIFMA/ICMA Global Master Repurchase Agreement (GMRA)

- 2000 TBMA/SIA Master Securities Loan Agreement (MSLA)

- 2017 SIFMA Master Securities Loan Agreement (MSLA)

- 2000 ISLA Global Master Securities Lending Agreement (GMSLA)

- 2010 ISLA Global Master Securities Lending Agreement (GMSLA)

The Protocol includes an Additional Documents Annex that provides a full list of Additional Master Agreements and Additional Credit Support Documents. Firms that are considering adhering to the Protocol should review this list to confirm whether all their trading documentation that references IBORs is included. Note that any exclusions or additions must be agreed bilaterally, for which ISDA has provided template language.

How will the Fallbacks apply?

The Protocol and Supplement use a waterfall of fallback rate options that apply if there is a temporary unavailability or cessation of an IBOR.

- Temporary unavailability

- Should an IBOR become temporarily unavailable, the waterfall of fallbacks is:

- First – to the rate for the reset date provided by the administrator;

- Second – to the rate recommended by that rate’s administrator (or its supervisor) if the First rate is unavailable within the specified timeframe; and

- Third – to an alternative rate determined by the Calculation Agent in a commercially reasonable manner if the Second rate is unavailable by the specified time.

- Should an IBOR become temporarily unavailable, the waterfall of fallbacks is:

- Index Cessation Events

- The Protocol and Supplement address two distinct types of “cessation”:

- Pre-Cessation Events are relevant only for IBORs in USD, GBP, EUR, CHF and JPY,1and occur if the UK’s Financial Conduct Authority (the “FCA”, being the regulatory supervisor for the administrator of LIBOR) publicly announces that (a) the relevant LIBOR is (or will on a specified future date be) non-representative, and (b) the announcement is intended to trigger the contractual fallbacks for pre-cessation.

- The pre-cessation fallbacks will become effective upon the earlier of (i) the relevant IBOR no longer being available, or (ii) the first date the relevant IBOR is non-representative, as specified in the announcement by that IBOR’s regulator or administrator.

- Note that the FCA has stated previously that such announcements could be published as early as Q4 of 2020. While it is unclear how the FCA intends to proceed, it seems reasonable to expect that this timing will be pushed back in view of the delayed publication and effective date of the Protocol and Supplement.

- Pre-Cessation Events are relevant only for IBORs in USD, GBP, EUR, CHF and JPY,1and occur if the UK’s Financial Conduct Authority (the “FCA”, being the regulatory supervisor for the administrator of LIBOR) publicly announces that (a) the relevant LIBOR is (or will on a specified future date be) non-representative, and (b) the announcement is intended to trigger the contractual fallbacks for pre-cessation.

- The Protocol and Supplement address two distinct types of “cessation”:

- Permanent Cessation Events occur upon the announcement by the relevant IBOR’s administrator, regulatory supervisor, or resolution authority or insolvency official with jurisdiction over the administrator, that it has ceased or will cease to provide that IBOR on a permanent or indefinite basis, and there is no successor administrator at that time.

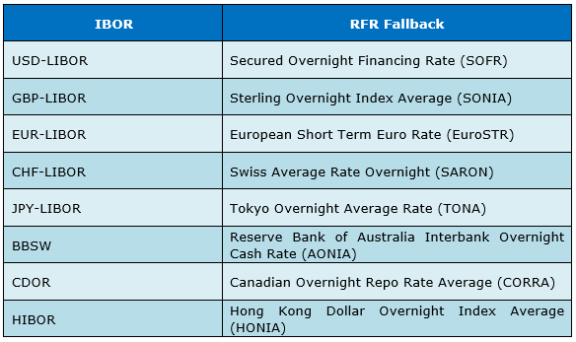

Upon the occurrence of an index cessation event, the initial fallback will be the risk-free rate (“RFR”) for that IBOR, as published or distributed by Bloomberg or its authorized distributors or successor. The table below provides a guide to the relevant RFRs:

There are additional fallbacks in the event the relevant RFR fallback is temporarily unavailable or an index cessation event applies to that RFR.

The RFRs are calculated using certain term and spread adjustments to account for the structural differences between the RFRs and the IBORs they replace. In particular, the RFRs are overnight rates, are backward looking, and do not price in bank credit risk or liquidity premiums for term funding. Since July 2020, Bloomberg has been publishing term-adjusted RFRs, the spread, and the “all-in” RFR rate (comprising both the term-adjusted RFR and the spread).

Is the Protocol right for you?

Protocol adherence is voluntary, as is the case for all previous ISDA protocols. However, the regulators have strongly encouraged regulated financial institutions and market participants to adhere to the Protocol. Accordingly, it should be expected that the major banks and swap dealers will, in turn, use their influence to prompt their buy-side counterparties to adhere. Regulators in the US and the EU have also provided comfort that amendments to legacy contracts for purposes of replacing the benchmark fallbacks, or replacing the IBORs with RFRs, will not trigger any clearing or margin requirements under their respective swap regulatory regimes.

In considering whether to adhere to the Protocol, market participants should review the Protocol in detail and assess its impact on their derivatives and investment portfolios. If they have not already, firms should also begin the process of analyzing the relevant RFR fallbacks and the extent of any basis risk with relevant IBORs, taking into account the spread and term adjustments. This assessment should also consider the impact of the Protocol and the RFRs on hedging transactions, basis risk between the derivatives book and other financial instruments or investments in the portfolio (e.g., loans, bonds, structured products, etc.), as well as any accounting, tax or regulatory issues that might be implicated in the transition from the IBORs to the RFRs. Firms should also consider the fact that the Supplement will automatically apply to (most) swap transactions entered into on or after January 25, 2021, which raises the prospect of maintaining a bifurcated swap portfolio in the event legacy swaps are not updated by incorporation of the Protocol terms.

Market participants considering using the Protocol mechanism can elect to adhere to the Protocol via the ISDA website, or incorporate the Protocol terms bilaterally into their agreements on an ad hoc basis. Adhering on the ISDA website portal would efficiently amend all relevant covered documents and transactions with all counterparties. On the other hand, proceeding on a bilateral basis would allow parties to expand or narrow the scope of the Protocol, or make other amendments to the Protocol terms (e.g., by including a dispute resolution process for calculation agent determinations, disapplying the pre-cessation fallbacks, etc.). Such amendments are not possible for parties that adhere to the Protocol on the ISDA portal, but will likely require time and additional costs, assuming the parties can agree to the amendments.

The Protocol allows for adherence by a party as agent, so that investment managers, for example, can adhere as agent for all their investment funds. Unlike certain previous ISDA protocols, there is no requirement for the agent to have executed the underlying documentation as agent on behalf of the principal, which should facilitate the adherence process for investment firms. However, the party acting as agent is required to provide reasonable evidence of its authority to amend the documentation within 15 days of a counterparty’s request.

Protocol adherence requires payment of a one-time fee of $500, which ISDA has waived for any party that is not an ISDA Primary Member and that adheres before January 25, 2021. As with previous ISDA protocols, there is a revocation process available if a party chooses to withdraw from the Protocol.

If you have any further questions about the Protocol or Supplement, please reach out to any of the contacts listed below, or contact your Seward & Kissel service provider.

Michele Navazio, Partner

navazio@sewkis.com

Lauri Goodwyn, Counsel

goodwyn@sewkis.com

Dan Bresler, Counsel

bresler@sewkis.com