1. Introduction and Summary

On July 30, 2024 – a mere 32 months after adopting a new regulatory framework for brokered deposits in December 2020 (the “Current Rules”) – the Federal Deposit Insurance Corporation (“FDIC”) issued a notice of proposed rulemaking (the “Proposal”) that, if adopted, would replace the Current Rules with a regulatory framework that reverts in some cases to the pre-2020 framework and in other cases to policies in place well before 2020. Comments on the Proposal are due 60 days after publication in the Federal Register.

The Proposal, approved by the FDIC board in a 3-2 vote along party lines, with the Democrats in favor and the Republicans strongly opposed, would, among other things:

- Enlarge the definition of “deposit broker” to encompass more institutions and intermediaries;

- Significantly curtail the availability of the “Primary Purpose Exception” (or, “PPE”) from the definition of “deposit broker”;

- Nullify existing PPEs; and

- Revamp the PPE notification and application process to grant the FDIC more discretion and lengthen the time permitted for the FDIC to consider such filings.

If adopted, the Proposal would dramatically increase the deposits that insured depository institutions (“IDIs”) would be required to classify as brokered and, therefore, likely force a shift in IDI funding strategies. Broker-dealers, FinTechs, and deposit intermediaries will doubtless feel the downstream effects. In summary, the following deposit arrangements, which are classified as non-brokered under the Current Rules, would be reclassified as brokered under the Proposal:

- Sweep deposits placed by a broker-dealer with its affiliated IDIs to the extent such deposits exceed 10% of the broker-dealer’s “assets under management” (“AUM”).

- Sweep deposits placed by a broker-dealer with its affiliated IDIs if a third-party intermediary proposes the deposit allocations.

- Funds swept from a non-advisory brokerage account to an IDI (an open question discussed below).

- Deposits placed using intermediary proposing deposit allocations (even if the intermediary does not know the deposit objectives of the IDI).

- Arrangements in which customers establish direct relationships with an IDI and a person receives a fee related to the deposits.

- Arrangements in which a person forms a relationship with a single IDI to establish exclusive deposit placement services.

- Arrangements in which 100 percent of depositors’ funds that a person places, or assists in placing, at IDIs are placed into transactional accounts that do not pay any fees, interest, or other remuneration to the depositor.

Moreover, the broadening of the definition of “deposit broker” would likely limit the ability of IDIs to rely on the statutory reciprocal deposits exception because deposits entering a deposit placement network must be non-brokered in order for an IDI to receive non-brokered reciprocal deposits under the exception.

There are numerous consequences of deposits being classified as brokered:

- There is an unofficial, but pronounced regulatory stigma attached to brokered deposits. Examination staff often have a strong view on an IDI’s brokered deposit funding levels.

- Less-than-well-capitalized IDIs are restricted in their ability to rely on brokered deposit funding.

- Large IDIs are subject to liquidity coverage ratio requirements, which require an IDI to hold enough high-quality, liquid assets to cover projected net cash outflows over a 30-day stress period. Brokered deposits have a higher projected outflow rate than non-brokered deposits, which would require an IDI to hold more high-quality, liquid assets against brokered deposits.

- Large IDIs are also subject to net stable funding ratio (“NSFR”) requirements, which require an IDI to maintain a minimum level of stable funding relative to the liquidity of their assets, derivatives, and commitments, over a one-year period. Brokered deposits are considered to be less stable and may be ineligible to help an IDI meet its NSFR requirements.

2. Critique of FDIC Rationale and Process

As it has done in prior rulemakings on brokered deposits, the FDIC argues that brokered deposits are less stable than non-brokered deposits and are “correlated” with bank failures, citing data that has not been subject to public scrutiny. In further support of the Proposal’s broadening of the types of deposits deemed brokered, the FDIC cites recent developments at Silicon Valley Bank (a run on uninsured deposits), Synapse (not a bank and not a bank failure), and Voyager (also not a bank and also not a bank failure). As Seward & Kissel has commented several times over the past two decades, including providing the FDIC with independent analyses of bank failure data prepared by various independent authorities, the empirical correlation between brokered deposits and bank failures is tenuous at best. The FDIC routinely ignores substantial brokered deposit use by successful healthy banks and negligible brokered deposit use by insolvent banks (see, e.g., Silicon Valley Bank). It also refuses to concede that banks fail because of deteriorating asset quality, not deposits.

As we have previously commented, if the FDIC were truly concerned about deposit stability, CDs offered through brokers should not be “brokered” because they are incapable of fleeing under stressed conditions due to highly limited early withdrawal provisions.

The Proposal, if adopted, would be vulnerable to challenge under the Administrative Procedure Act as “arbitrary and capricious.” The Proposal’s reversal of the Current Rules seems not to be the product of new evidence, but rather simply of a change in composition of the FDIC board.

We also note that at the same meeting the Board voted to release the Proposal for public comment, the Board voted to solicit public comment on a request information (“RFI”) on the stability of deposits, also citing the failure of Silicon Valley Bank. The FDIC leaves unstated how it can be so authoritative when describing deposit stability in the Proposal while at the same time conceding in the RFI that it lacks information on deposit stability.

3. Deposit Broker Definition

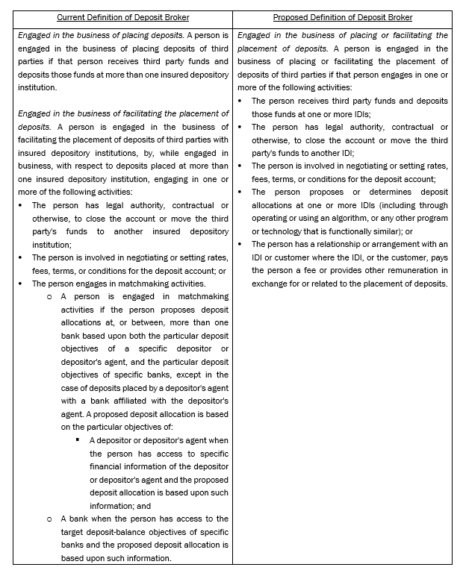

A greater number of institutions and intermediaries would be considered “deposit brokers” under the Proposal than under the Current Rules. Under the Current Rules, a fee paid to an institution or intermediary in connection with a deposit arrangement does not, without more, cause the institution or intermediary to be a deposit broker. The Proposal would reverse this and provide that an institution or intermediary receiving a fee “related to the placement of deposits” is a “deposit broker.” Thus, such deposits would be brokered deposits unless a specific exception applies. The Proposal would therefore annul one of the most significant changes made by the Current Rules and roll back the clock to before 2020, when fees were a key consideration in determining whether deposits were brokered.

This change would impact certain FinTech deposit arrangements. In the so-called “banking as a service” or “BaaS” model, FinTech platforms offer customers the ability to open deposit accounts directly with an IDI. In some cases, the IDI pays a fee to the FinTech platform for referring depositors. Under the Current Rules, these deposits can be considered non-brokered. Under the Proposal, these deposits would be brokered. Many of the IDIs supporting BaaS arrangements rely heavily on such deposits for funding, and the categorization of these deposits as brokered may, depending on the FDIC’s supervisory views, force these IDIs to alter their businesses.

The Proposal also attempts to simplify and clarify when an intermediary is a deposit broker by replacing the somewhat convoluted “matchmaking activities” test and replacing it with a simpler formulation focused on whether the intermediary proposes or determines deposit allocations (through an algorithm or otherwise). The FDIC was motivated to propose this change by some institutions and intermediaries attempting to skirt the “matchmaking activities” test in the Current Rules by claiming that certain deposit allocations were determined by “non-discretionary algorithm[s.]” These arguments have clearly peeved the FDIC for years.

The proposed changes to the definition of “deposit broker” are set forth below.

4. Primary Purpose Exception

a. In General

The Proposal would narrow the availability of the PPE. Under the Proposal, an IDI would only be able to rely on the PPE if:

- The deposit arrangement is subject to certain enumerated exceptions (which are unchanged from the Current Rules1);

- The deposit arrangement complies with the 10% Test and the FDIC does not object to the IDI’s notice (described below); or

- The FDIC approves the IDI’s PPE application (described below).

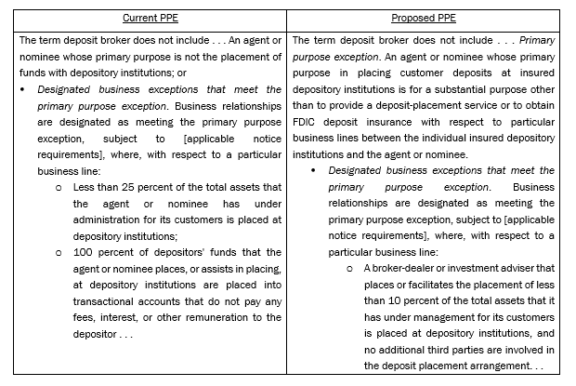

b. The 25% Test Changes to the 10% Test

Under the Current Rules, deposits qualify for a PPE if, with respect to a particular business line, “less than 25 percent of the total assets that the agent or nominee has under administration for its customers is placed at depository institutions” (the “25% Test). The Proposal would reduce the 25% figure to 10% (the Proposal’s test, the “10% Test”). Under the Current Rules, any institution placing deposits at IDIs (including other IDIs, trust companies, and unregistered custodians) is eligible for the PPE under the 25% Test. The Proposal would limit eligibility for the PPE under the 10% Test solely to broker-dealers and investment advisers registered with the Securities and Exchange Commission (“SEC”). The FDIC seemingly does not understand that, by law, investment advisers cannot custody client assets and thus cannot place deposits.

Perhaps even more significantly, the Proposal would change the term “assets under administration” (“AUA”) to AUM. The distinction between AUA and AUM is fraught. In the proposal preceding the adoption of the Current Rules, the FDIC used the term AUM. Seward & Kissel and others commented that the term AUM was inappropriate, given that many institutions placing deposits at IDIs do not “manage” assets. The FDIC recognized its mistake in adopting the Current Rules, stating in the preamble to the Current Rules that, in direct contrast to the term AUM, the term AUA refers to “both customer assets managed by the agent or nominee and those customer assets for which the agent or nominee provides certain other services but may not exercise deposit placement or investment discretion.”

Though the term AUA is, in our view, imperfect, it is at least grounded in an understanding that IDIs, trust companies, broker-dealers, and other custodians may place funds on behalf of their customers even though they may not manage those funds.

In the Proposal, the FDIC expressly disavows its previous (and correct) understanding in imposing the term AUM, stating that “[AUM] would be appropriate under the proposed rule to accurately reflect the scope of the types of services provided by broker dealers [sic] and investment advisers. The Proposal would define [AUM] to mean securities portfolios and cash balances with respect to which an investment adviser or broker-dealer provides continuous and regular supervisory or management services.”

There are major problems with this change. While AUM is an appropriate term for measuring the activity of an investment adviser that actively manages client assets, it is inappropriate for measuring the custody of client assets by broker-dealers that are not dually registered with the SEC as investment advisers. The FDIC appears wholly unaware that many broker-dealers do not have the legal authority to manage any client assets.

Worse yet, the FDIC’s misunderstanding of the investment management industry results in an ambiguous description of how broker-dealers must calculate the PPE percentage. The Proposal states that the PPE is available “where, with respect to a particular business line, a broker-dealer or investment adviser that places or facilitates the placement of less than 10 percent of the total assets that it has under management for its customers is placed at depository institutions” [syntax errors in the original].

Does this mean that the only deposits placed by a broker-dealer eligible for the PPE are funds from customers with advisory accounts? Moreover, since many broker-dealers hold no advisory accounts, are those broker-dealers de facto ineligible for the PPE since the denominator of the 10% calculation would by definition be zero?

Finally, the Current Rules permit an intermediary to propose deposit allocations between affiliated institutions without causing the deposits to be brokered. The Proposal would reverse this permission and, accordingly, many affiliated sweep deposits that are currently non-brokered would be brokered if the Proposal is adopted.

The proposed changes to the 25% Test are set forth below.

c. The Enabling Transactions Test

The Current Rules state that a person is not a “deposit broker” if “100 percent of depositors’ funds that the agent or nominee places, or assists in placing, at depository institutions are placed into transactional accounts that do not pay any fees, interest, or other remuneration to the depositor” (the “Enabling Transactions Test”). The Proposal eliminates the Enabling Transactions Test.

d. Exclusive Deposit Placement Arrangements

The Current Rules provide for exclusion from the deposit broker definition for situations in which a third party forms an arrangement with a single IDI to establish exclusive deposit placement services. An IDI can have such exclusive deposit placement arrangements with more than one third party, with the deposits placed by each third party qualifying for the exclusion. This exclusion currently applies when a FinTech partners with one IDI and when an IDI’s wholly owned subsidiary acts as a deposit broker placing (or facilitating placement of) deposits with its parent. The Proposal eliminates this exclusion.

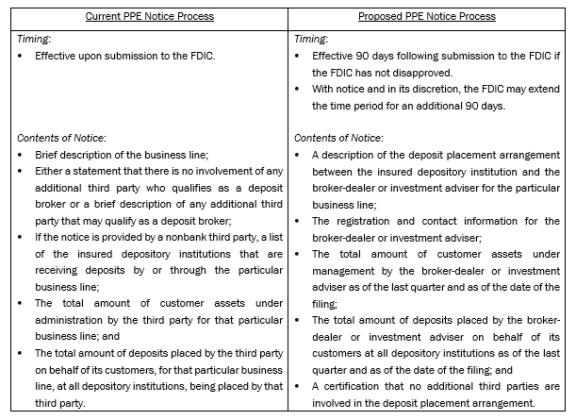

5. PPE Notice Process

The Proposal’s stated goal is to revert the PPE to “be similar to how the FDIC historically interpreted the exception before 2020,” which had been crafted “through long-standing staff advisory opinions and published FAQs.” The Proposal does not discuss whether these prior staff advisory opinions (many of which were, in fact, unpublished), which were officially moved to inactive status under the Current Rules, will be formally reinstated or the degree to which these prior documents will guide the FDIC’s analysis going forward.

In furtherance of the FDIC’s desire to travel back to the future, the Proposal would make major changes to the process for obtaining a PPE under the 10% Test. First, the Proposal would nullify all existing PPEs obtained through either the notice or application process, including all broker-dealer sweep program PPEs obtained under the 25% Test. A broker-dealer with an existing PPE would not be permitted to make a filing to re-gain its PPE; rather, each individual IDI receiving sweep deposits from the broker-dealer would have to file a notice with the FDIC to obtain relief under the 10% Test, and such notice would only be effective after 90 days. The FDIC would have discretion to extend this timeframe by 90 additional days. What is more, the clock would re-set to zero if the FDIC deemed the notice incomplete. In contrast, PPE notices are effective upon submission under the Current Rules.

As part of the notice, an IDI would need to provide the FDIC with information on all the deposits placed by a broker-dealer with all other IDIs. The Current Rules permit a broker-dealer to submit a notice or application primarily because only the broker-dealer knows this information. Unmentioned in the Proposal is the fact that pre-2020 PPE advisory opinions were in many cases issued to broker-dealers, not IDIs.

Finally, the 10% Test would be available only when there are no third parties involved in the sweep arrangement. The presence of a third-party intermediary in a sweep arrangement would require an IDI to file an application, rather than a notice, even if the third party does not propose deposit allocations.

The proposed 10% Test notice process is set forth below.

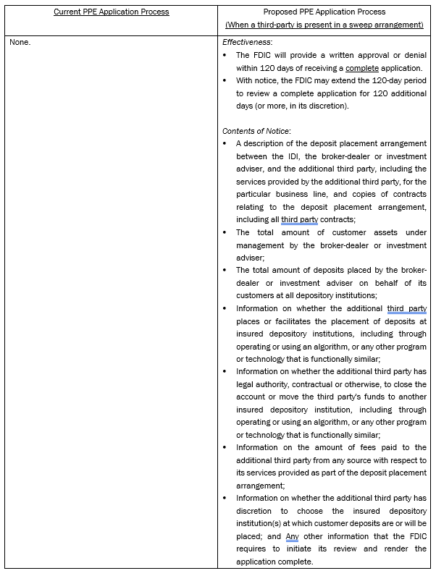

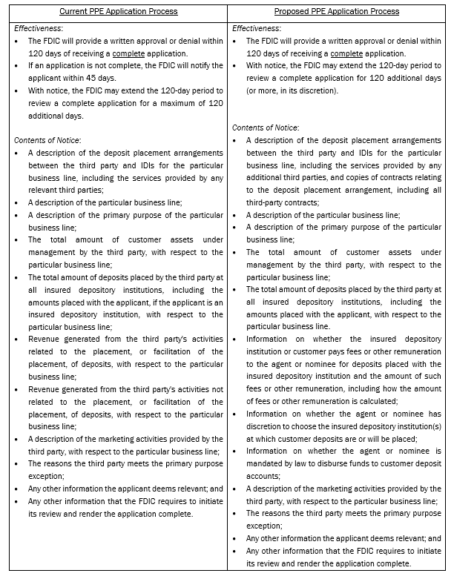

6. PPE Application Process

The Proposal contains two similar, but distinct, application processes. One process would be used for the 10% Test when a third-party is present and the third party does not propose deposit allocations for the arrangement. The second process would be for all other PPEs except for the enumerated exceptions.

Under both proposed processes, the FDIC would greatly increase its discretion to delay providing an applicant with a formal approval, denial, or notice that more information is required. Under the Current Rules, the FDIC must notify a PPE applicant within 45 days whether the application is complete. The FDIC imposes no such requirement on itself under the Proposal. Under the Current Rules, the FDIC may extend the timeline for approving or denying an application for a maximum of 120 additional days. The FDIC grants itself the discretion to extend the timeline for an indeterminate length of time under the Proposal.

Lastly, the Proposal is silent on whether the FDIC will provide any public information on applications that have been approved or denied. This is a marked contrast with the preamble to the Current Rules, which states that the FDIC intends to make PPE application approvals publicly available in redacted form. This important omission from the Proposal may indicate the FDIC’s desire to impose “black box” regulation, which would very much be in keeping with its stated goal of reverting brokered deposit regulation to the pre-2020 world.

The following chart sets forth details on the application process under the 10% Test when a third party is present.

All other applications for the PPE must follow the process set forth below.

7. Brokered CDs

The Current Rules provide that brokered certificates of deposit (“Brokered CDs”) are always brokered and are ineligible for the PPE in all respects. The Proposal leaves the treatment of Brokered CDs unchanged.

To download a PDF version of this memo, please click here

* * * * *

Seward & Kissel LLP will continue to provide insight on developments regarding brokered deposits. If you have any questions, please contact Casey Jennings or Paul Clark in the Washington, DC office at 202-737-8833.