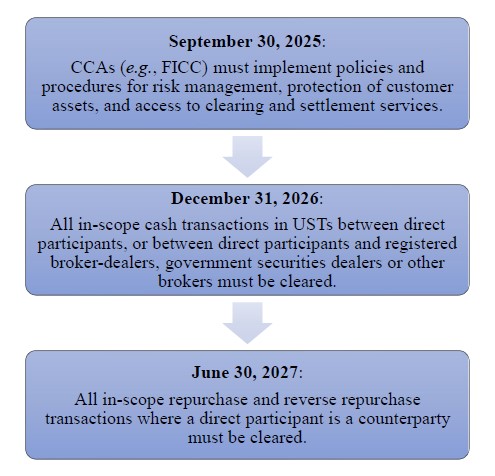

On February 25, 2025, the SEC released a statement extending the compliance deadlines to clear US Treasury (“UST”) repo and cash transactions under the US Treasury Clearing Rule (“Clearing Rule”) by one-year.1 In the statement, the SEC’s Acting Chairman Mark T. Uyeda acknowledged the critical role UST markets play in the global financial system and the importance of proper implementation of the Clearing Rule. He states that a one-year extension “provides additional time to implement and validate operational changes” and that the SEC will continue to engage with market participants during the implementation process. The statement also extends by six months the deadline for covered clearing agencies (“CCAs”) to implement written policies and procedures to comply with the Clearing Rule.

A summary of the new compliance deadlines is provided below:

For additional background on the Clearing Rule, please refer to our previous Client Alert: The SEC Approves Mandatory Clearing of Transactions in US Treasury Securities – Issues for the Buy Side to Consider.

As always Seward & Kissel remains available to answer any questions that arise regarding the impact of and compliance with the Clearing Rule. Please reach out to any of the members of Seward & Kissel’s Derivatives Practice group listed below or contact your Seward & Kissel attorney.

Please click the link below to view the full memorandum on this topic.